Enhanced Coverage Option (ECO)

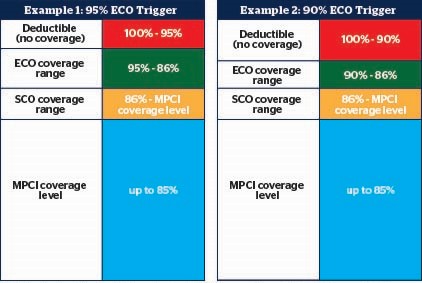

ECO is an area-based supplemental shallow-loss coverage that covers loss from 86% up to 90% or 95%. The endorsement is offered on select crops across the U.S. Please contact your NAU Country Agent or Marketing Representative for further information about coverage level and crop availability.

Why enhance with ECO?

- ECO offers up to 95% coverage, which is the highest subsidized multi-peril coverage available.

- ECO is county-based*, which benefits producers whose yield and revenue correlate with the county.

- ECO can trigger an indemnity on only a 5% loss in revenue or yield (dependent on the underlying MPCI coverage plan)

*ECO is based on Production Area, which many times is equivalent to the county. However, it is important to remember that they can differ. Production Area for ECO/SCO/ARP. The geographical area that the expected and final area yield are based on, designed generally as a county, but may be a smaller or larger geographical area as specified in the actuarial documents.

Upcoming 2027 changes

The Risk Management Agency (RMA) will update the Supplemental Coverage Option (SCO) policy for the 2027 Crop Year to increase the maximum coverage level from 86% to 90%. The expectation is thar RMA will also update ECO to cover from 90 to 95% for the 2027 Crop Year.

Purchase decisions

- Producers must purchase an individual buy-up policy to purchase ECO.

- ECO is an endorsement to Actual Production History (APH), Yield Protection (YP), Revenue Protection (RP), Revenue Protection with the Harvest Price Exclusion (RP-HPE), or a Yield-Based Dollar Amount of an Insurance policy.

- ECO follows the coverage of your underlying policy.

- A Yield Protection coverage means ECO covers yield losses.

- A Revenue Protection coverage means ECO covers revenue losses.

- Projected and harvest prices for ECO will match the individual coverage.

- Producers may purchase the Supplemental Coverage Option (SCO) along with ECO.

- Producers are not required to purchase SCO, they can leave a gap in coverage.

- ECO is not impacted by Farm Program decisions, including Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC).

- ECO's subsidized rate for revenue and yield plans is 80%.

- If a producer buys ECO, the producer may not:

- Purchase Margin Protection (MP), Margin Coverage Option (MCO), Margin Protection with the Harvest Price Option (MP-HPO), Area Revenue Protection Insurance (ARPI), Hurricane Insurance Protection Wind Index (HIP-WI), or other area plans.

- Apply ECO on acres that are already covered by Stacked Income Protection (STAX).

Indemnity details

- ECO expected and final yields are based on RMA data, NOT producer yields.

- ECO indemnities will be paid in the summer following the crop year, NOT at harvest time.

- ECO and individual coverage trigger independently, it is possible for a grower to have:

- An ECO indemnity, but no individual indemnity.

- An individual indemnity, but no ECO indemnity.

- Indemnities from both programs.

- No indemnities.

ECO on a Revenue Protection policy example**:

The Expected Area Yield is 200 bu./acre and the Projected Price is $5.00/bu. The producer elects a 95% ECO coverage.

- The Coverage Range is the selected ECO coverage level less 86%:

95% - 86% = 9%

The producer has an Approved Yield of 210 bu./acre.

- The ECO Amount of Insurance is determined as the Expected Revenue (using the insured's APH) is multiplied by the Coverage Range:

($5.00 x 210 bu./acre) x 9% = $94.50/acre

For illustrative purpose, suppose the Premium Rate is 45%.

- Total Premium is calculated by multiplying the ECO Amount of Insurance and Premium Rate:

$94.50/acre x 45% = $43.00/acre - Premium Subsidies are determined by multiplying Total Premium by the Subsidized Rate:

$43.00/acre x 80% = $34.00/acre - Producer Premium is determined by subtracting the Premium Subsidy from the Total Premium:

$43.00/acre - $34.00/acre = $9.00/acre

The Harvest Price is $4.80/bu. and the Final Area Yield is 190 bu./acre.

- Multiply these numbers to find the Final Area Revenue:

$4.80/bu. x 190 bu./acre = $912/acre - The Loss Percentage is determined by taking the Loss Trigger (90%/95%) less the Final Area Revenue divided by the Expected Area Revenue:

Max (95% - ($912/acre ÷ $1,000/acre = 3.80%), 0 - The Payment Factor is determined as the Loss Percentage divided by the Coverage Range:

3.80% ÷ 9% = 42.22% - The Payment Factor is then multiplied by the ECO Amount of Insurance to determine the ECO indemnity:

$94.50/acre x 42.22% = $39.90/acre

**Yields, prices, and rating data are examples only.